January 5, 2022

Amartha chooses Element Inc. to provide MSMEs access to loans

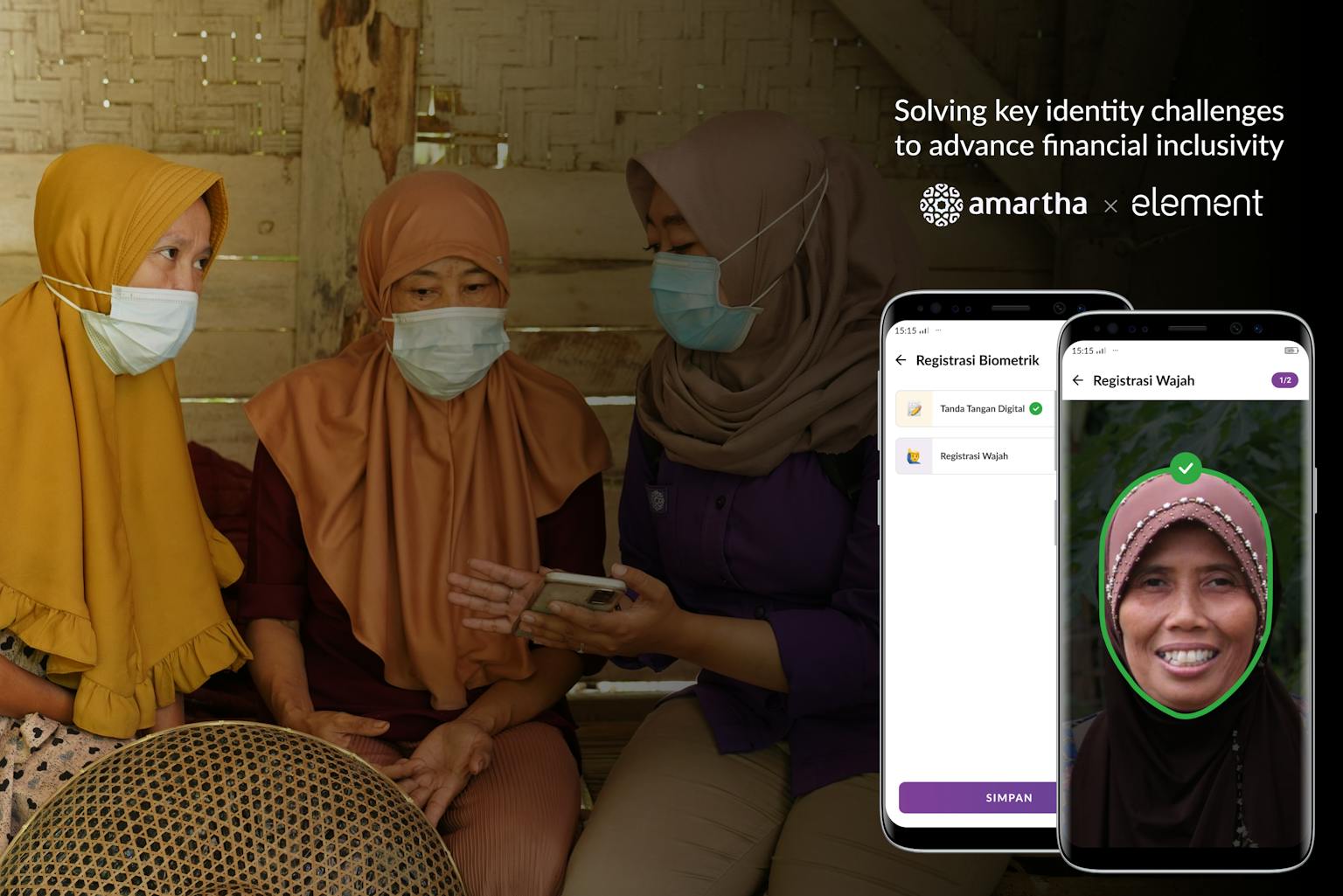

Amartha, a leading financial technology company of Indonesia focusing on providing inclusive financial products for female entrepreneurs, has partnered with Element Inc., a global digital identity solutions provider, to give micro, small, and medium enterprises (MSMEs) easier access to loans.

As part of a significant technology innovation initiative for Amartha’s customers and field agents, this partnership for digital onboarding and authentication will provide speed-ups in loan disbursement approvals and processing times, reduce errors, and substantially eliminate the risks of identity fraud. By implementing Element Inc.'s high performance selfie enrollment, advanced liveness technologies, and automated identity document processing for a borrower’s national ID card (e-KTP), Amartha can safely provide loans to unbanked entrepreneurs without the latencies of the traditional manual processes. The combination of these solutions has increased access to funding for aspiring micro and small business entrepreneurs which contribute to 60% of Indonesia's GDP.

Element was founded in 2012 by Adam Perold and Yann LeCun, Turing Award Laureate credited with developing the modern field of artificial intelligence, who also serves as Chief AI Scientist of Meta (formerly known as Facebook), and Silver Professor of New York University. Element focuses on providing digital identity and risk solutions to financial institutions, e-commerce platforms, and other partners.

“At Element, our mission is to solve key identity and access challenges to connect more people to essential services, to help them build a more financially-liberating lifestyle. Amartha is playing an important role in providing millions of underserved micro-entrepreneurs over the coming years with opportunities to grow and prosper. We have long been inspired by their dedication to empower female entrepreneurs, and are excited about the scale of growth and impact such a prestigious financial platform is creating.” said Mr. Perold.

Amartha was established in 2010 as a microfinance company, developing many product innovations and becoming one of the leading sustainable, high growth financial technology companies in Indonesia. Amartha focuses on serving the underserved and unbanked populations by providing productive loans exclusively for women in the rural communities. To date, Amartha operates in more than 19,000 villages in Java, Sumatra, and Sulawesi. Amartha manages more than 900,000 micropreneur women and has successfully disbursed over five trillion rupiah (USD 350 million).

Andi Taufan Garuda Putra, Founder & CEO Amartha explained, “Amartha’s operations include a hybrid system, which combines the online and offline strategies. In the online strategy, we apply machine learning and relevant datasets to form an accurate credit scoring model for our borrowers, as well as use a number of metrics to ensure their debt levels are balanced and sustainable. In the offline strategy, we manage almost 3,000 field agents to monitor and provide financial services in the villages. The offline operation presents a significant opportunity for digitization in the rural areas. Thus, this collaboration with Element is expected to foster substantial benefits for the efficiency and scalability of our financial services products and operations for our customers.”

With the rise of fintech in Indonesia, inclusive financing for underserved communities have presented a large-scale opportunity for positive economic impact and growth. Element Inc.'s digital onboarding, authentication, and security and anti-fraud technologies have helped institutions like Bank BRI, the largest retail bank of the country with 75 million customers, in providing secure and efficient access to financial services.

Also featured in:

Indotelko, Kontan (Keuangan), Industry.co.id, Riau Editor, Press Release, Berita Moneter, Jakarta Jive, Spirit News Indonesia, Harian Haluan